24+ Payoff amount calculator

Say you found out you owed 3000 on a Chase Sapphire Preferred Card with an interest rate of 2299 APR 1749 - 2449. 193 per month will payoff credit line in 24 months indicates required.

2

The effect can save you thousands of dollars in interest and take years off of your auto loan.

. Monthly Payment The amount of money applied to the balance on a monthly consistent basis. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18.

The amount you are. Please view the report to see detailed calculation results in tabular form. Ultimate Loan Payoff Calculator Borrow or pay any amount on any date at any rate.

The 1st payment is. The amount you are currently paying per month on this line of credit. I was anticipating the monthly income to be in the region of 700.

30-Year Fixed Rate Mortgage. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings. Average Daily Balance The base amount used to calculate credit card interest charges.

For instance if your monthly payment is 119354 its biweekly counterpart is 55086. By paying extra 50000 per month the loan will be paid off in 14 years and 4 months. The mortgage payoff calculator helps you find out.

The accelerated biweekly version will be higher at 59677. That helps you understand if you can afford a loan you can see if the monthly payment amount would even fit in your. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching.

Ideally youd like to get rid of the debt as quickly as possible while building up the amount of money you have invested in the home. Use the Fixed Payments tab to calculate the time to pay off a loan with a fixed monthly payment. Line of credit information.

Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. Credit Card Payoff Calculator. Using our Credit Card Payoff Calculator youd need to pay 200 a.

This additional amount accelerates your loan payoff by going directly against your loans principal. To give you an idea see the table below. March 10 2016 at 159 pm.

Your regular payment amount. Finance Charge Interest charged for borrowed money. We used the calculator on top the determine the results.

The accelerated amount is slightly higher than half of the monthly payment. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. Am I using the calculator incorrectly or is the calculator not intended for this purpose.

Because we calculated the payment amount assuming 24 payments we need to edit row 2. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in. Total interest paid for amortizing payments.

If you would like to pay twice monthly enter 24 or if you would like to pay biweekly enter 26. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Accelerated repayments pay off loan in 4 years and 7 months Line Graph.

Lets say you have a 220000 30-year mortgage with a 4 interest rate. Line of Credit Payoff Calculator Canadian. Use this free hard money loan spreadsheet and the other formulas we provide anytime you are considering buying a property to fix and flip.

The calculator calculates a monthly income of 138998 but not for the period entered ie 24 years the result shows that the income will run out on 31082035 a period of 14 years not 24. November 1 2015 at 824 pm. Try this free feature-rich loan calculator today.

Loan amount - the amount borrowed or the value of the home after your down payment. The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. It allows you to take all those various factors and crunch them into a single formula to figure out what your payments are likely to be.

Looking for a flexible free downloadable loan calculator built in Excel. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. Annual Fee The amount you pay every year to your credit card company for maintaining your credit card.

But those are exactly what this Line of Credit Payoff Calculator is designed to do. While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card. Even experienced house flippers overlook certain expenses associated with flipping properties.

193 per month will payoff credit line in 24 months This entry is Required. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. 30-Year Fixed Mortgage Principal Loan Amount.

The remaining term of the loan is 24 years and 4 months. Please enter the amount you actually pay not the minimum payment. The AARP mortgage calculator.

If youre borrowing for 2 years you would enter 24. This amount is used to calculate how long it will take. This loan calculator works for flips in Florida Texas California and all 50 states.

Amount of time until the loan is paid off. Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

Has highly-competitive interest rates at 599 APR to 2899 APR for non-New York residents and 599 APR to. To convert terms of years into months multiply the number of years by 12. If youre borrowing money for 6 months you would enter 6.

Use the Fixed Term tab to calculate the monthly payment of a fixed-term loan.

Complex Analysis Saff Snider Pdf

Minimal Design Fillable Balance Sheet And Income Statement Etsy Balance Sheet Balance Sheet Template Excel Templates Business

10 Budget Management Templates Pdf Word Pages Free Premium Templates

Investordaypresentation

Free 24 Sample Payment Schedules In Pdf Ms Word

Christmas Gift Shopping List Word Doc 24 Christmas Wish List Template To Fill Out By Everyone Christmas Wish List Template Christmas Wishes List Template

What Is Financial Literacy Advance America

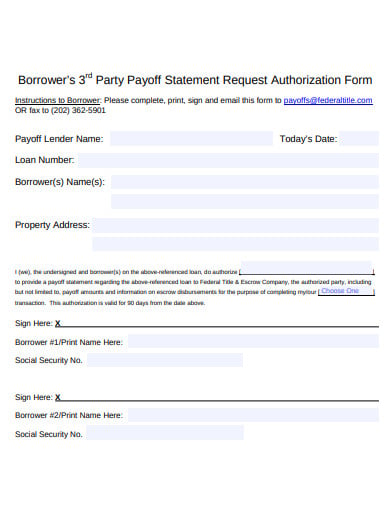

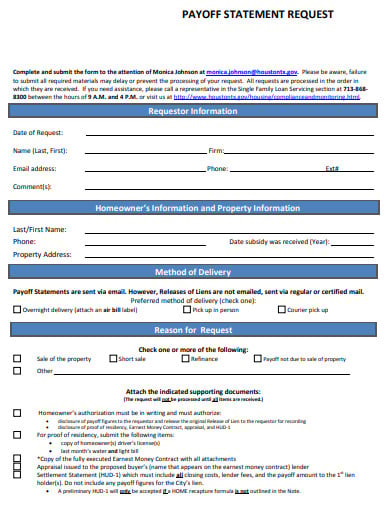

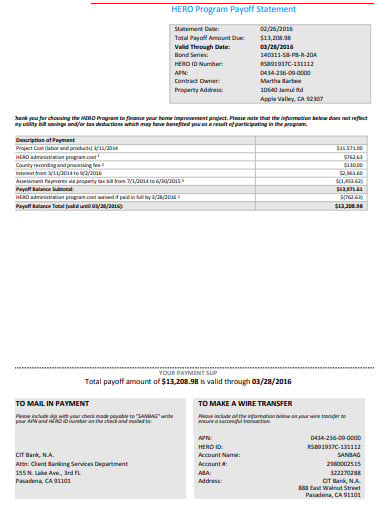

13 Payoff Statement Templates In Pdf Free Premium Templates

Job Application Template Word Inspirational Job Application Template 24 Examples In Pdf Word Job Application Template Job Application Employment Application

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

16 Useful Service Invoice Templates Excel Word Find Word Templates

2

How Much Does The Average Wedding Cost Nerdwallet Wedding Costs Average Wedding Costs Wedding Expenses

Pin On Excel Tips

Explore The Bilvam Regency Project In Surat Real Estates Design Real Estate Brochures Real Estate Marketing Design

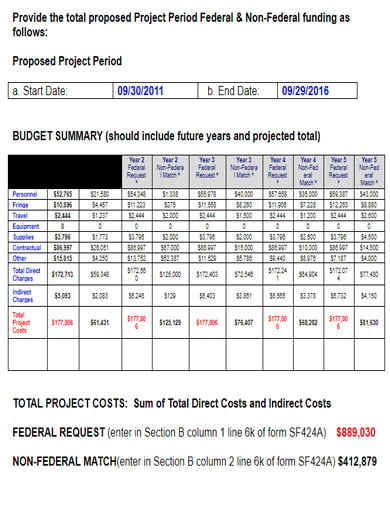

Investordaypresentation